This article covers Canada Post Tracking and highlights the possibilities available to shippers and recipients and the overall process followed by Canada Post when it comes to Tracking Canada Post shipments. It covers the compatibility with WooCommerce Canada Post Plugin and provides the reader with the knowledge on how to handle Shipment Tracking with the WooCommerce Canada Post plugin.

What is a Tracking Number?

A Shipment Tracking number is a unique numeric/alphanumeric code. Shipping carriers like the Canada Post, assign packages with the tracking number while shipping. With this tracking number, you, as well as your customers can track your shipment while the package is in transit. It also includes the estimated delivery date and to confirm if the package has been delivered.

Can Canada Post customers track their shipments?

Yes.Tracking numbers with Canada Post are normally 16 numeric digits (2649751103465807), or 13 alphanumeric characters (LM019723854CA).

There are 3 ways in which customers can track their package, they are:

- By using the Tracking Number

- Using the Delivery Card Notice

- Reference Number provided by the Shipper

How do you find the Canada Post tracking number for your shipment?

You have to check the Receipt, Package or Delivery Notice Card which was delivered via mail as it will contain the Canada Post tracking number. You can also request for the Reference number from the sender.

What are the details that Canada Post provides with the tracking numbers / What are the benefits of the Canada Post tracking number?

In case you deliver only to Provinces within Canada, then the Canada Post tracking number will provide you with the following information:

- It tells you when the package was first created in the Canada Post system

- Provides you with the details of when Canada Post received the package

- Canada Post provides you with the delivery update

- You will have to direct yourself to the Pickup Point once the delivery notice card is sent to the recipient.

In case you deliver Internationally, then the Canada Post tracking number will provide you with the following information:

- It tells you when the package was first created in the Canada Post system.

- Provides you with the details of when Canada Post received the package

- It tells you when the package was dispatched and when it was accepted/received at the Foreign Postal Administration.

- You are even able to see when the delivery notice card was sent to the recipient to notify them that the package is ready for pickup

- You are provided with the delivery update (when the package was delivered)

Which are the services that do not support Canada Post Tracking?

Business owners and the recipients are unable to track the following services in Canada Post

- Registered Mail™ International

- Small Packet™ – USA

- Small Packet™ – International

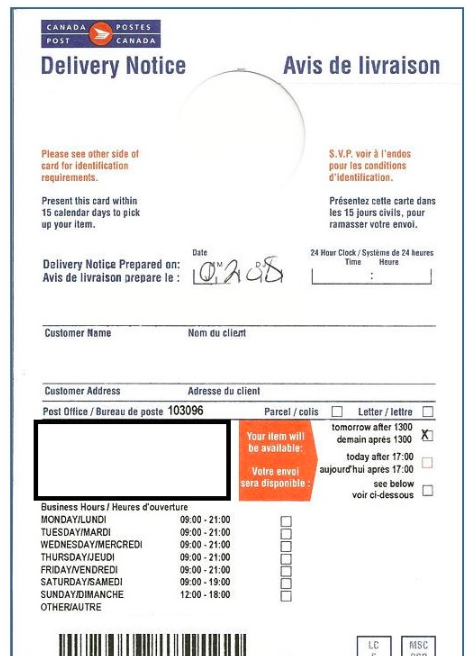

What is the use of a Delivery Notice Card with Canada Post?

The Delivery Notice Card is provided to the consignee of the package in case the package was not delivered or for any of the below-mentioned reasons:

- If the community mailbox is full then the delivery executive will leave the delivery notice in the community mailbox. This is to notify you that you will have to pick up the parcel from the authorized Pickup point.

- In cases where the mailbox is not big enough to hold the package.

- When no one was available to receive the item at the doorstep and in cases where there is no secure location to drop off the package or leave it.

- In the case where the shipper has requested for the option ‘card for pickup’ then the recipient will have to pick up the package from the post office

As a customer, if you have received a Delivery Notice Card you will have to follow the instructions listed on the card in order to pick up the package. If not, you can check the status on the package using the Canada Post Tracking Number and when the information is available on the Canada Post Tracking page you will be notified when and where you can pick the package from. **You may wonder if there is anything that you must carry in order to pick up the package, there are two options available to keep in mind while picking up packages from a post office/pickup point, these are:If the recipient is picking up the package at the Post Office then they have to carry:

- Delivery Card Notice

- Valid Government issued Photo-ID

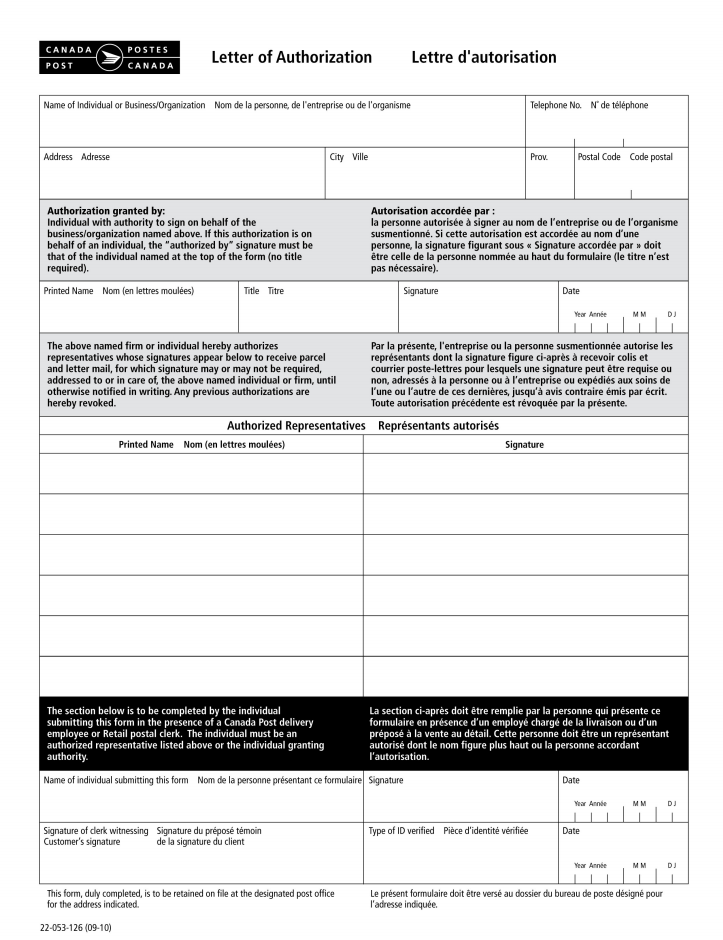

If the recipient can not pick up the package and rather has a third-party member to pick up the package from the Post Office then that person will have to carry:

- Delivery Card Notice – The recipient will have to sign the Delivery Card Notice and also specify the name of the person who has been sent to pick up the package.

- Letter of Authorization demonstrating the authority provided to them to pick up the package.

The criteria used to determine the Pickup Locations

After the delivery team attempts the delivery and are unsuccessful in doing so based on the points highlighted above. Based on the space available at the location, proximity and services offered you will be provided with your designated pickup location. Pickup points change with each delivery and once deposited at the registered pickup point, the pickup location CAN NOT be changed.

What are the Reference Numbers?

Reference numbers are those numbers which are generated by Shippers. There are chances that the reference numbers may have duplicates within the system as they have been generated by the Shipper. Canada Post provides the user with the option to track their packages using reference numbers.Enter the reference number in the Track Order section of Canada Post and you will be taken to a Shipping date range section. Here you will have to select the approximate date range during which the package was shipped. Upon doing so the tool provides you with the relevant tracking information for the package.

What do I do in case of a delay in the delivery for an International Order?

Both the shipping service and the destination country, determine the delivery time. While shipping internationally, the items must clear the customs process and delays can occur at times when the volume of the package is high. This process must be followed and can not be stopped or sped up by either Canada Post or the Postal Administration of the destination country as it is in the hands of the Customs department.

*The best option is to utilise the Canada Post tracking number and follow the updates provided by Canada Post.

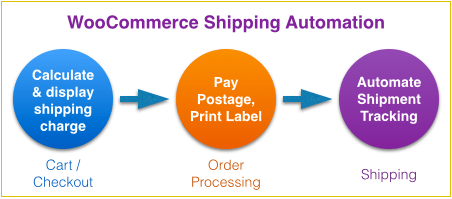

Canada Post Tracking with WooCommerce Shipping

Tracking Canada Post packages within WooCommerce is not entirely possible and would require integration with the Canada Post API. That is where the WooCommerce Canada Post plugin comes in handy. The plugin not only allows the user to receive Real-time rates and Print Shipping Labels & Manifests but also gives the shipper and recipient the ability to Track their packages.

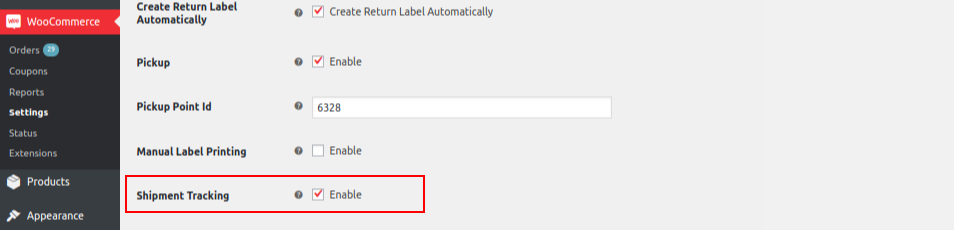

Once the plugin has been setup, in order to receive the tracking information for Canada Post Shipments by using the WooCommerce Canada Post plugin, you will have to Enable the service within the Plugin settings. To do so you will have to navigate to WooCommerce > Settings > Shipping > Canada Post. Scroll to the bottom of the settings page and enable Shipment Tracking (shown below)

Check the Enable Shipment Tracking option as it allows the plugin to add Tracking Details to the Order. Apart from this, the Order confirmation email will contain the Tracking Information embedded in it.

*The tracking numbers work in a Live environment ONLY and will not function within a Test environment.

- Enable Shipment Tracking in the plugin to obtain the following in your orders.

- First, place an order in the store and navigate to that particular order and Generate Packages.

- When the packages have been generated the Canada Post API pre-defines the Shipment Number and the Tracking Pin.

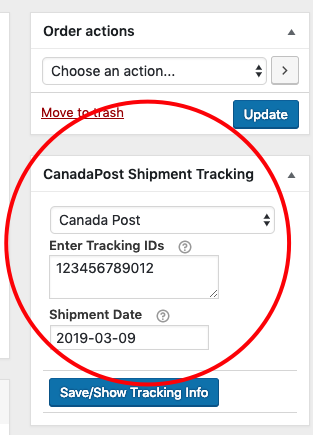

- View the tracking number under ‘Canada Post Shipment Tracking‘ in the order page (shown below)

In the images below you can see the Shipment Tracking number (123456789012). This is a generic test number that is created in the Test environment. This number will change to the authentic Canada Post Tracking Number in a Live environment.

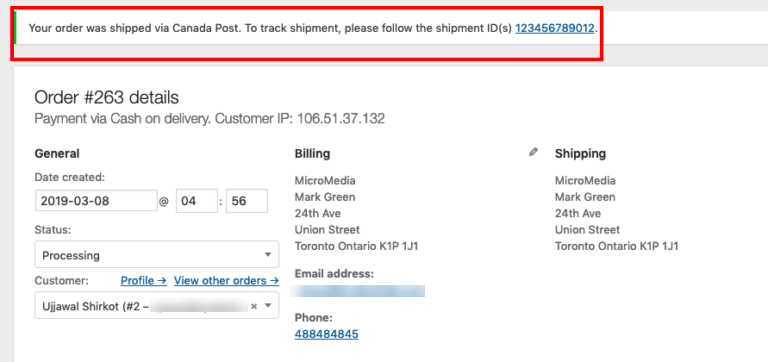

On the View Order page, you are able to see the Canada Post Tracking Number shown below. This section will specify if the package has one or more than one tracking number. This information will be sent accordingly to the Customers email once the order has been marked Completed.

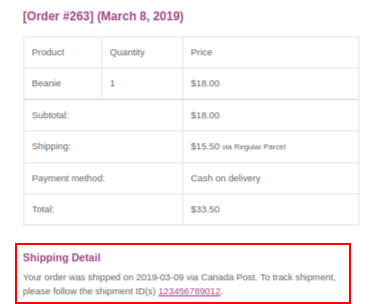

Mark the order status as Completed. Sending the order confirmation email is an automatic process. This email consists of the Order details as well as the Shipping and Billing Addresses. Apart from this, the Order Confirmation/Completion email also contains the Canada Post Tracking number/s for the package/s. (shown below)

As a customer, you’re also able to locate the package using the Canada Post Tracking tool.

Final Thoughts…

This article covers Canada Post Tracking and its features. It also covers how you can make the best use of the Canada Post Shipment in your WooCommerce store using the WooCommerce Canada Post Shipping plugin. The plugin is the best tool to accomplish all your shipping needs with ease within WooCommerce. It supports all the available services listed by Canada Post. Live shipping rate calculation, label generation within the WooCommerce store, live shipment tracking, and much more!